Shyam Sundar Arunachalam - 09 December 2023

With globalization, cross border transactions are now as common as local transactions. Factors like manufacturers expanding their supply chain across borders , global investment flows, cross border asset management and increased IT/BPO outsourcing activities have fuelled this growth multi fold

However, they bring with them as many risks as the rewards. One of such foremost risks for every global business organization is the foreign exchange risk where the currencies are not pegged and swing in response to world events.

The FX Rate risk is currently heightened given the confluence of factors like Geopolitical risk (war and conflicts) expected rate cuts by US FED , ECB and BOE. Not only accounting standards, but common prudence also demands that companies and businesses that have international exposure should be aware of these risks and employ risk management strategies to adequately mitigate these risks.

The Exposure and do the treasurers have a complete line of sight?

Most organizations having international presence or participating in cross border trade are invariably exposed to the vagaries of currency fluctuations unless they are operating in currencies that are pegged to each other.

Recognized Assets/Liabilities

- Foreign currency assets/debts

- Equity Investments

- Inventory

- Commodity

- Receivables/AR

- Variable Rate Debt

- Payables/AP

Unrecognized Firm Commitments

- Sales Orders

- Purchase Orders

- Projects

Forecasted Transactions

- Expected Sales/Purchases

- Expected Borrowings

Net Investment in Foreign Operation

- Foreign operations like Subsidiaries, Associates, Joint Ventures, Branches, etc.

The challenge most treasurers face is lack of real time and complete availability of data about the underlying exposure in various currencies and an estimate of timing of these cash flows. So any organization that is implementing enterprise applications and processes should be mindful of the specific reporting requirements that Treasurers have around real time access to firm and forecasted FX exposure.

What is a Currency Forward Contract?

Currency Forward is an effective hedging instrument that can help businesses manage their currency exchange rate fluctuation risks. They are OTC contracts and that offers them the ability to be customized according to the requirements of the contract parties. The contract helps lock in an exchange rate for a currency pair tied to a notional amount for a specific settlement period and protects the businesses from unfavorable fluctuations. However, they also prevent the businesses from benefiting from favorable fluctuations. In essence, they offer certainty and stability that the accounting standards so mandate!

Multiple FX Forward contracts are entered into by companies with their banking counterparts and the maturity of these contracts are usually tied to the due dates of the underlying exposures

Linking an FX Forward to an Underlying exposure

In an ideal scenario, you can systematically assign the specific FX Forward contracts to a specific group of underlying exposures differentiated by the maturity dates. You are also ideally able to assign one underlying exposure to multiple FX forward contracts if need be. The linking helps you to be in complete control of how much to hedge and potentially avoid over-hedging or under-hedging situations.

Ideally you have a defined FX hedge policy part of your broader FX risk management strategy that defines your FX Hedge ratio to avoid individual poor decisions and a shared accountability

Translating the Accounting Principles in a FX Forward Contract for the Accountants

1. What do you need to record/document a FX Forward Contract?

To record FX Forward contracts, a currency pair with the Reference Spot Rate on the Contract Start Date and contracted Forward Rate is needed. This would give the local currency amount that would be needed to buy the corresponding foreign currency amount on the Maturity Date.

The benchmark source for each of the currencies in the currency pair should also be determined so that they can be used in periodic valuation, till the contract maturity.

Hedge Accounting applicability should be decided/determined based on the business needs, while also considering statutory requirements. If Hedge Accounting is proposed to be applied, the Hedge Type should then be determined depending on the risks proposed to be hedged, which will govern the accounting.

If the fair value change risk is proposed to be hedged, then Fair Value Hedge should be applied. If the cash flow variability risk is proposed to be hedged, then Cash Flow Hedge should be applied. Though the aforesaid statements are simple, each case would need to be evaluated to ascertain the specific risk being hedged which will then determine the Hedge Type.

2. Mark-To-Market FX Forward Contract Periodically

FX Forward contracts, i.e., the Hedging Instrument should be periodically valued, till the date of its maturity. Such Fair Value can be determined using Discounted Cash Flows Method (explained below) or can be directly obtained from the banks in some cases.

For each of the currency, using the benchmark source linked, the following factors like the Days to Maturity from the Valuation Date, Interest Rates determined from the Yield Curve are used to derive the interpolated interest rate and then the discount factor. The Yield Curve is constructed based on the interest rates available in the system for a range of maturities. Using the discount factor so computed, the buy amount and sell amount are computed in an equivalent manner and forward swap points are calculated by comparing them both.

The forward swap points are folded into the Spot Exchange Rate on the Valuation Date and Forward Revaluation Rate is determined.

Revaluation Gain/Loss is calculated as the difference between the Fair Value based on the Forward Revaluation Rate and the Fair Value based on the Contract Forward Rate.

Underlying Hedged Items are also revalued based on their own linked benchmark source. Similar to FX Forward contract, the interpolated interest rate differentials are used to determine the discount factor which is then applied to the Underlying Hedged item's value. Based on the difference in Fair Value, the gain/loss on the Underlying Hedged Item is determined.

3. What should you do on FX Maturity?

On the date of maturity, a final valuation is performed by comparing the Contract Forward Rate and Actual Spot Rate as on that date and the resulting gain/loss is recorded. On the Maturity Date, the balance in Cash Flow Hedge Reserve (in case of Cash Flow Hedge Type) should be transferred to Income Statement.

4. When should we test for Hedge Effectiveness?

Hedge effectiveness testing is required to be done both prospectively as well as retrospectively. While the former determines the effectiveness of a hedge, the latter measures the effectiveness of a hedge.

Prospective testing typically involves matching of critical terms and should be performed at the inception and every valuation date. This can be done through Critical Terms Matching method by matching the nominal amount, currencies, interest rates, duration, maturity date, etc.

Retrospective testing is done to measure the hedge effectiveness by comparing the net change in the Fair Value of the Hedging Instrument ie., FX Forward Contract vis-à-vis the net change in the Fair Value of the Hedged Item ie., Underlying. This should also be performed at every valuation date.

5. Accounting treatment

The accounting treatment for a FX Forward contract depends on Hedge Accounting applicability. If Hedge Accounting is proposed to be applied, then it further depends on the type of hedge - Fair Value Hedge or Cash Flow Hedge.

| No Hedge Accounting/ Fair Value Hedge | ||

|---|---|---|

| Scenario | Debit | Credit |

| Gain on FX Forward contract | Gain on FX Forward contract | Unrealized Gain (P&L) |

| Loss on FX Forward contract | Unrealized Loss (P&L) | FX Forward Contract (Asset) |

The difference between No Hedge Accounting scenario and Fair Value Hedge Accounting scenario is the treatment of the Hedged Item i.e., Underlying. In the case of Fair Value Hedge Accounting scenario, the gain/ loss on Hedged Item is also simultaneously recognized in the Income Statement thereby offsetting each other.

| No Hedge Accounting/ Fair Value Hedge | ||

|---|---|---|

| Scenario | Debit | Credit |

| Gain on FX Forward contract (Effective) | FX Forward Contract (Asset) | Cash Flow Hedge Reserve (OCI) |

| Gain on FX Forward contract (Ineffective) | FX Forward Contract (Asset) | Unrealized Gain (P&L) |

| Gain on FX Forward contract (Ineffective) | Cash Flow Hedge Reserve (OCI) | FX Forward Contract (Asset) |

| Loss on FX Forward contract (Ineffective) | FX Forward Contract (Asset) | FX Forward Contract (Asset) |

The following illustration depicts the accounting treatment in some scenarios outlined above

Illustration - On 1-Jan-2024, an investment company based out of Dubai whose functional currency is AED proposes to make an investment of 2.5 million EUR in a Euro Fund, in 2 months’ time i.e., 1-Mar-2024. Given the ongoing geopolitical risks and other factors, the company enters into a FX Forward Contract and fixes AED outflow as AED 10,175,000 by locking Forward Rate of 4.07 for 1-Mar-2024.

This is a classic case of Cash Flow Hedge involving Cash Flow Hedge Reserve.

On Contract Start Date 1-Jan-2024

Irrespective of whether Hedge Accounting is applied or not, no accounting entries are recorded on the Contract Start Date.

Mark to Market on 31-Jan-24 where the Forward Revaluation Rate is determined as 4.0752 and FX Forward Value is computed as AED 13,000 with the net change being AED 13,000.

If Hedge Accounting is not applied/ Fair Value Hedge accounting is applied, the entire gain/ loss is recognized immediately in the income statement as they occur:

| Dr | Forward Contract Account (Asset) | AED 13,000 | - |

| CR | Unrealized Gain on Forward Contract Account (P&L) | - | AED 13,000 |

If Hedge Accounting (Cash Flow Hedge Type) is applied, the gain is accumulated in Cash Flow Hedge Reserve account in Other Comprehensive Income:

| Dr | Forward Contract Account (Asset) | AED 13,000 | - |

| CR | Cash Flow Hedge Reserve Account (OCI) | - | AED 13,000 |

Mark to Market on 29-Feb-24 where the Forward Revaluation Rate is determined as 4.0733 and FX Forward Value is computed as AED (8,250) with net change being AED (21,250).

If Hedge Accounting is not applied/ Fair Value Hedge accounting is applied, the entire gain/ loss is recognized immediately in the income statement as they occur:

| Dr | Unrealized Loss on Forward Contract Account (P&L) | AED 21,250 | - |

| CR | Forward Contract Account (Asset) | - | AED 21,250 |

If Hedge Accounting (Cash Flow Hedge Type) is applied, the effective portion is repurposed from Cash Flow Hedge Reserve account to the extent available, while the ineffective portion is recognized in the Income Statement:

| Dr | Cash Flow Hedge Reserve Account (OCI) | AED 13,000 | - |

| CR | Unrealized Loss on Forward Contract Account (P&L) | AED 8,250 | - |

| CR | Forward Contract Account (Asset) | - | AED 21,250 |

Contract Maturity on 1-Mar-24 at the Forward Rate of 4.07 with Spot Rate being 4.08; FX Forward Value is computed as AED 25,000 with net change being AED 33,250.

If Hedge Accounting is not applied/ Fair Value Hedge accounting is applied, the entire gain/ loss is recognized immediately in the income statement as they occur:

| Dr | Forward Contract Account (Asset) | AED 33,250 | - |

| CR | Realized Gain on Forward Contract Account (P&L) | - | AED 33,250 |

On Maturity, settlement with banks also happens, which will nullify the FX Forward account balance:

| Dr | Bank (Incoming at Spot Rate) | AED 10,200,000 | - |

| CR | Forward Contract Account (Asset) | - | AED 10,200,000 |

| Dr | Forward Contract Account (Asset) | AED 10,175,000 | - |

| CR | Bank (Outgoing at Forward Rate) | - | AED 10,175,000 |

If Hedge Accounting (Cash Flow Hedge Type) is applied, the gain is accumulated in the Cash Flow Hedge Reserve account to Income Statement, and the following entries happen:

| Dr | Forward Contract Account (Asset) | AED 33,250 | - |

| CR | Cash Flow Hedge Reserve Account (OCI) | - | AED 33,250 |

On Maturity, settlement with banks also happens, which will nullify the FX Forward account balance:

| Dr | Bank (Incoming at Spot Rate) | AED 10,200,000 | - |

| CR | Forward Contract Account (Asset) | - | AED 10,200,000 |

| Dr | Forward Contract Account (Asset) | AED 10,175,000 | - |

| CR | Bank (Outgoing at Forward Rate) | - | AED 10,175,000 |

Additionally, Cash Flow Hedge Reserve balance will be recycled to the Income Statement. This is timed to match with the Hedged Item gain/loss reporting:

| Dr | Cash Flow Hedge Reserve Account (OCI) | AED 33,250 | - |

| CR | Realized Gain on Forward Contract Account (P&L) | - | AED 33,250 |

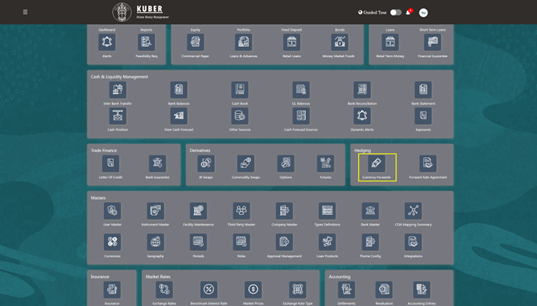

How can Kuber TMS™ help you manage your FX Forward Contracts?

Our product Kuber TMS™ with a simple, user-friendly interface is indeed a David to the Goliath that are the sophisticated treasury products. One such complex treasury product that we offer is the aforesaid Currency Forwards and the application of Hedge Accounting requirements

Our product Kuber TMS™ with a simple, user-friendly interface is indeed a David to the Goliath that are the sophisticated treasury products. One such complex treasury product that we offer is the aforesaid Currency Forwards and the application of Hedge Accounting requirements need better zoomed in screenshots of Kuber TMS FX Management. Ideally we should have a separate section for FX Management that has Exposures and FX Forward Contract. Will share this

Kuber TMS(™) - A Comprehensive tool for FX forward deal management

Currency Forward contracts help businesses hedge the currency fluctuation risk by locking an exchange rate. Kuber TMSTM covers the following aspects of Currency Forward management:

- 📌 Creation of Underlying Hedged Item ie., Firm Commitment/ Forecast/ Asset/ Liability with its relevant details

- 📌 Creation of Currency Forward contract ie., Hedge Instrument for the currency pair with details like the Amounts, Reference Spot Rate/ Contract Forward Rate, Contract/ Settlement Date etc

- 📌 Ability to use different bank accounts for the outflow and inflow in different currencies

- 📌 Ability to record and account for charges/ fees in desired currency

- 📌 Linking of Hedge Instrument with the Hedged Item and linking currencies to the relevant benchmark sources for calculation of interest rate differentials for use in valuation

- 📌 Assessment of Hedge Effectiveness using Critical Terms Matching method

- 📌 Valuation of Hedge Instrument and Hedged Item using discount factor derived from interpolated differential interest rates based on the selected source

- 📌 Assessment and Measurement of hedge effectiveness using Critical Terms Matching method as well as Dollar Offset Method

- 📌 Splitting of Hedge Instrument value into effective and ineffective portion, depending on the Hedge Type, for the purposes of accounting

- 📌 Generation of relevant accounting entries in draft status enabled for transfer to ERP GL

- 📌 Comprehensive picture of the OCI Reserve account along with its movement and running balance, in case of Cash Flow Hedge type

- 📌 Automatic transfer of OCI Reserve balance at the end of hedge relationship

- 📌 Automatic transfer of OCI Reserve balance at the end of hedge relationship

We cover other hedge instruments and derivatives too like Interest Rate Swaps, Commodity Swaps, Forward Rate Agreements etc. For a personalized consultation and to discover how Kuber TMS™ can customize and automate your treasury operations seamlessly:

Kuber TMS™

Spend your precious time on investment research and leave the Accounting/ Reporting to us

Integrating Kuber TMS™ with your existing ERP system will simplify the process of accounting for transactions with your equity accounted investees.

For a personalized consultation and to discover how Kuber TMS™ can automate your process and accounting:

- Email: [email protected]

- Visit us at www.kubertms.com Let's unlock the potential of your Treasury Department together.